Ever spent hours trying to claim an extended warranty from your credit card provider, only to be met with confusion and frustration? Trust me, you’re not alone. A shocking 67% of consumers have no idea how to navigate their credit card benefits, leaving thousands of dollars’ worth of warranties unclaimed every year. Today, we’ll dive into everything you need to know about filing a hassle-free claim application. From unraveling the mystery behind extended warranties to walking through actionable steps for a successful submission, this guide has got you covered!

You’ll learn:

- What exactly a credit card extended warranty is (and why it’s a game-changer)

- A step-by-step process for completing your claim application

- Best practices to maximize your chances of approval

- Real-world examples that illustrate successful claims

Table of Contents

- Key Takeaways

- Understanding Credit Card Extended Warranties

- Step-by-Step Guide to Filing Your Claim Application

- Tips & Best Practices for Smooth Applications

- Real-World Examples of Successful Claims

- FAQs About Claim Applications

Key Takeaways

- Credit card extended warranties can save you hundreds—sometimes even thousands—on repairs or replacements.

- A properly executed claim application requires organization, patience, and attention to detail.

- Common mistakes include missing deadlines, incomplete documentation, and failing to review terms beforehand.

- Increase your odds by keeping meticulous purchase records and understanding what’s covered under your policy.

What Exactly Is a Credit Card Extended Warranty?

Let’s face it—most people skim over those fine print details when signing up for a new credit card. But buried in there might just be one of the best perks ever: the credit card extended warranty. Essentially, these programs extend the manufacturer’s warranty on eligible purchases—usually doubling its length. For instance, if your TV came with a one-year warranty, your credit card might bump it up to two years. Sounds amazing, right?

But here’s the kicker: actually using this benefit often involves submitting a claim application, which leads us directly into today’s topic.

How to File a Seamless Claim Application in 5 Easy Steps

Optimist You: “I’ve got nothing better to do than fill out forms!”

Grumpy You: “Yeah, unless snacks are involved…” Here’s how to make it suck less.

Step 1: Gather All Documentation

Before starting your claim application, gather all receipts, original warranties, and proof of purchase. Yes, annoyingly detailed prep work matters.

Step 2: Verify Coverage Terms

Read the fine print to confirm whether the item qualifies. Some exclusions apply (e.g., perishables like food or plants).

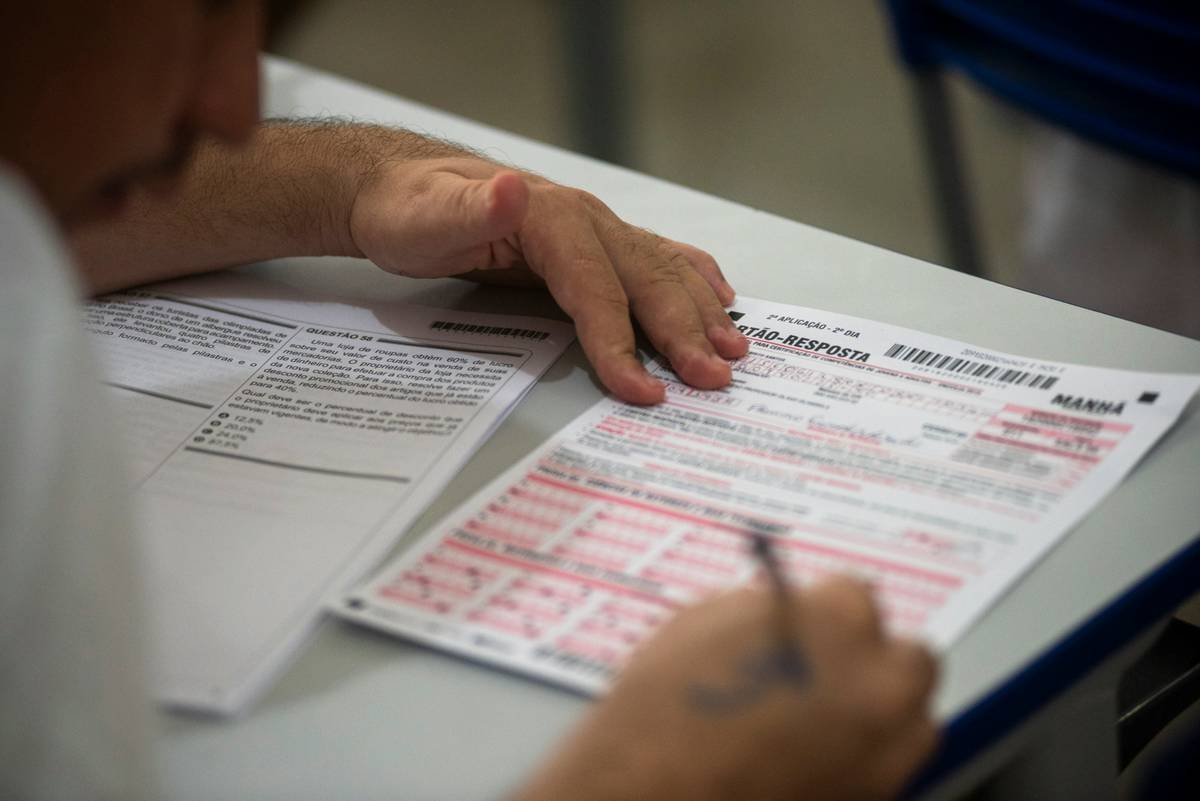

Step 3: Fill Out the Form Carefully

Most issuers will provide an online form. Double-check each field before hitting “submit.” Errors = delays.

Step 4: Submit Supporting Documents

Email scans of your documents or upload them via portal. Make sure files are legible!

Step 5: Follow Up Consistently

If you don’t hear back within two weeks, follow up politely. Persistence pays off.

Top 5 Tips for Nailing Your Claim Application

- Create a Paper Trail: Organize digital copies of receipts and warranties immediately after purchase.

- Know Deadlines: Most policies require claims within 30 days of repair/damage—set reminders!

- Be Honest: Don’t inflate costs or exaggerate damages; fraud detection exists for a reason.

- Use Customer Service Wisely: Chatbots seldom help—call customer support instead.

- Avoid This Terrible Tip: Sending incomplete or blurry documents. Seriously, folks—it’s lazy.

Rant Corner:

Why must companies design such clunky interfaces for submitting claims? It’s like navigating a labyrinth built by bureaucracy trolls. Ugh. Give us streamlined portals already!

Success Stories That Prove It’s Worth the Effort

Take Sarah, who saved $800 replacing her laptop battery thanks to a well-prepared claim application. Or John, whose $2,000 refrigerator replacement turned painless due to organized documentation. These stories aren’t rare—they happen daily; you just need to try.

Claim Application FAQs

Can I file multiple claims at once?

Yes, but separate each item clearly in your application.

Do all credit cards offer extended warranties?

No. Check your issuer’s terms—you may find limited options among low-tier cards.

What happens if my claim gets denied?

Appeal with additional evidence or clarify any misunderstandings via phone call.

Wrapping Up Like a Zen Master Who Loves Nostalgia

Filing a claim application doesn’t have to feel like pulling teeth. By following our guide, staying organized, and maintaining perseverance, you’ll unlock the secret sauce to leveraging your credit card’s extended warranty feature effectively.

Like dial-up internet from the ‘90s, this system isn’t perfect—but hey, it works. Now go forth and conquer those claims!

Haiku Time:

Paperwork whispers,

Fingers tap, hope rises,

Approval arrives.