Hook: Have you ever felt like your credit card’s extended warranty is a mystical creature that only exists in the fine print? We get it—navigating the claims process can feel like a puzzle. But what if we told you it doesn’t have to be that way?

Purpose: In this post, we’ll demystify the process of submitting extended warranty claims for your credit card. From understanding what an extended warranty is to the step-by-step guide on how to file a claim, we’ve got you covered.

Preview: You’ll learn how to check your card’s benefits, gather the necessary documents, and submit your claim with ease. Plus, we’ll share some tips, real-world examples, and even a few rants to keep things interesting.

Table of Contents

- Key Takeaways

- Problem/Background

- Step-by-Step Guide

- Tips and Best Practices

- Examples and Case Studies

- FAQs

Key Takeaways

- Understand the importance and benefits of your credit card’s extended warranty.

- Learn how to check your card’s specific warranty coverage.

- Get a step-by-step guide on how to gather and submit the necessary documents.

- Discover tips and best practices to make the process smoother.

- Explore real-world examples and case studies for additional insights.

Problem/Background: Why Is This Important?

Imagine you just bought a brand-new laptop, and three months later, it decides to go kaput. You’re frustrated, and the last thing you want to do is shell out more money for a replacement. This is where an extended warranty comes in. An extended warranty on your credit card can provide additional coverage beyond the manufacturer’s warranty period, saving you from unexpected expenses.

But here’s the catch: not everyone knows they have this benefit, and even fewer know how to use it. That’s why we’re here to help.

Step-by-Step Guide: How to Submit Your Extended Warranty Claim

Step 1: Check Your Card’s Benefits

First things first, you need to confirm that your credit card offers an extended warranty. Check your card’s terms and conditions or contact your bank’s customer service for details. Some cards may offer up to two years of additional coverage, while others might have different limits.

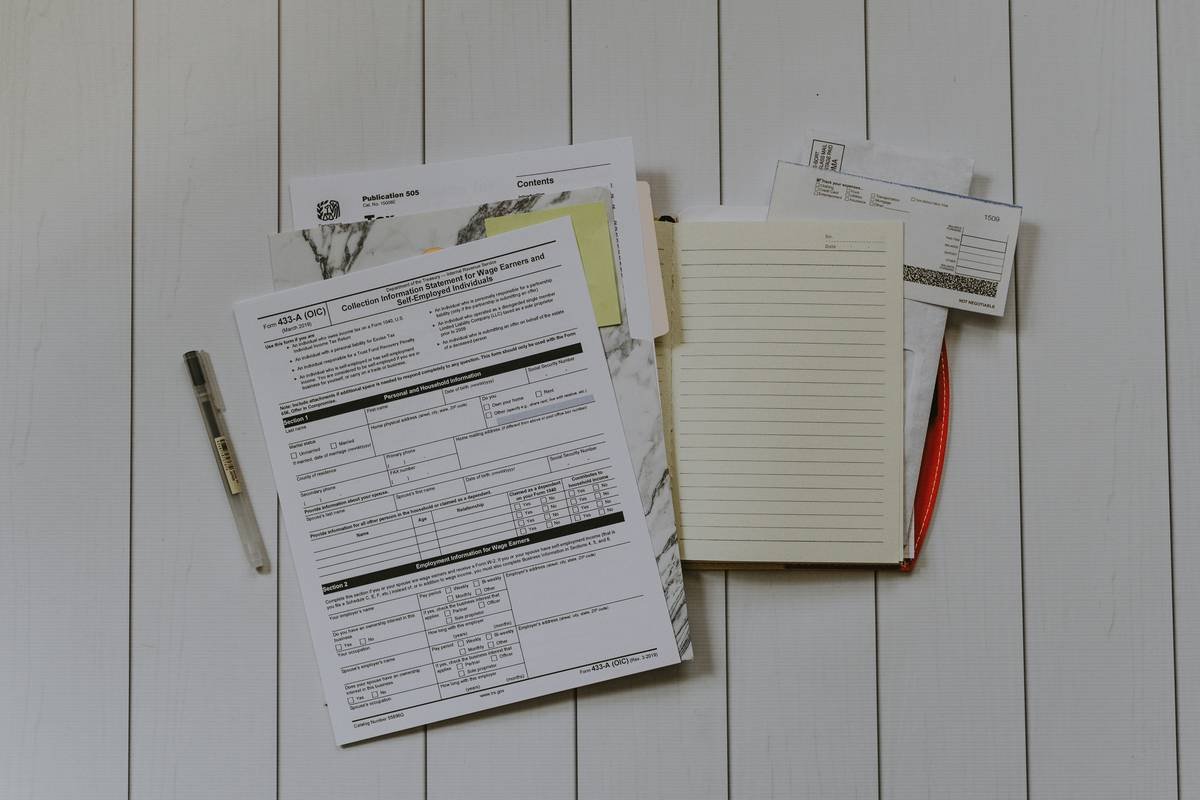

Step 2: Gather the Necessary Documents

Once you’ve confirmed your card’s benefits, start gathering the required documents. These typically include:

- Your credit card statement showing the purchase.

- The original receipt or invoice.

- The manufacturer’s warranty information.

- Proof of the issue (e.g., photos, repair estimates).

Step 3: Fill Out the Claim Form

Find the claim form on your card issuer’s website. Fill it out carefully, providing all the requested information. Be sure to double-check for accuracy before submitting.

Step 4: Submit Your Claim

Submit your completed claim form along with all the supporting documents. You can usually do this online, but some issuers may require you to mail the documents. Make sure you follow the specific instructions provided by your card issuer.

Tips and Best Practices

- Read the Fine Print: Always read the terms and conditions of your card’s extended warranty. Each card may have different coverage, exclusions, and procedures.

- Keep Receipts: Keep all your receipts and documentation in a safe place. It’s much easier to find them when you need them if they’re already organized.

- Act Quickly: Don’t wait too long to file your claim. Most extended warranties have a time limit for submissions, so act fast once an issue arises.

- Follow Up: If you don’t hear back about your claim, follow up with the card issuer. Persistence can sometimes speed up the process.

Grumpy You: ‘Ugh, who has time for all this paperwork?’

Optimist You: ‘Trust me, it’s worth it. Just think of all the money you’ll save!’

Examples and Case Studies

Case Study 1: John’s New Smartphone

John bought a new smartphone using his credit card, which came with a one-year manufacturer’s warranty. Six months after the warranty ended, the phone started having battery issues. John submitted an extended warranty claim and received a full refund for the cost of the phone.

Case Study 2: Sarah’s Appliance Nightmare

Sarah bought a high-end washing machine using her credit card. After 18 months, the machine stopped working. She submitted an extended warranty claim and had the machine repaired at no cost to her.

FAQs

- What is an extended warranty on a credit card?

- An extended warranty on a credit card provides additional coverage beyond the manufacturer’s warranty period, often adding up to two years of extra protection.

- How do I check if my credit card has an extended warranty?

- You can check your card’s benefits by reviewing the terms and conditions or contacting your bank’s customer service.

- What documents do I need to submit an extended warranty claim?

- You typically need your credit card statement, the original receipt, the manufacturer’s warranty information, and proof of the issue (e.g., photos, repair estimates).

- How long does it take to process an extended warranty claim?

- The processing time can vary, but it usually takes a few weeks. Be sure to follow up if you don’t hear back within the expected timeframe.

- Can I file a claim for a product that was gifted to me?

- This depends on the specific terms of your card’s extended warranty. Generally, the item must have been purchased with the credit card to be eligible for coverage.

Conclusion

Navigating the world of credit card extended warranties can seem daunting, but with the right information and steps, it becomes much more manageable. By understanding your card’s benefits, gathering the necessary documents, and following the proper procedures, you can protect yourself from unexpected expenses and make the most of your credit card’s perks.

Remember, the key to success is to stay informed and proactive. And if you ever feel overwhelmed, just remind yourself that you’re not alone. We’ve all been there, and sometimes, a little humor goes a long way.

Like a Tamagotchi, your financial peace of mind needs daily care.