### Introduction

Ever found out too late that your expensive gadget wasn’t covered by insurance?

Welcome to the world of credit card extended warranties, where a little-known perk can save you from the frustration of unexpected repair or replacement costs. In this post, we’ll dive deep into how you can make the most of your covered accessories, ensuring you get the maximum benefit from your credit card’s hidden gems.

You’ll learn:

- The importance of understanding extended warranties

- A step-by-step guide to checking and using your warranty

- Tips and best practices for maximizing coverage

- Real-world examples of people who benefited from these warranties

- Frequently asked questions about covered accessories

### Table of Contents

– [Problem/Background](#problem-background)

– [Step-by-Step Guide/Instructions](#step-by-step-guide-instructions)

– [Tips/Best Practices](#tips-best-practices)

– [Examples/Case Studies](#examples-case-studies)

– [FAQs](#faqs)

### Key Takeaways

– **Understanding Extended Warranties**: Why they matter and how they work.

– **Checking Your Coverage**: Steps to verify if your accessory is covered.

– **Maximizing Benefits**: Tips to ensure you get the most from your warranty.

– **Success Stories**: Real examples of people who saved money with extended warranties.

– **Common Questions Answered**: Clarifying the often-confusing aspects of covered accessories.

### Section 1: Problem/Background

Why Are Covered Accessories So Important?

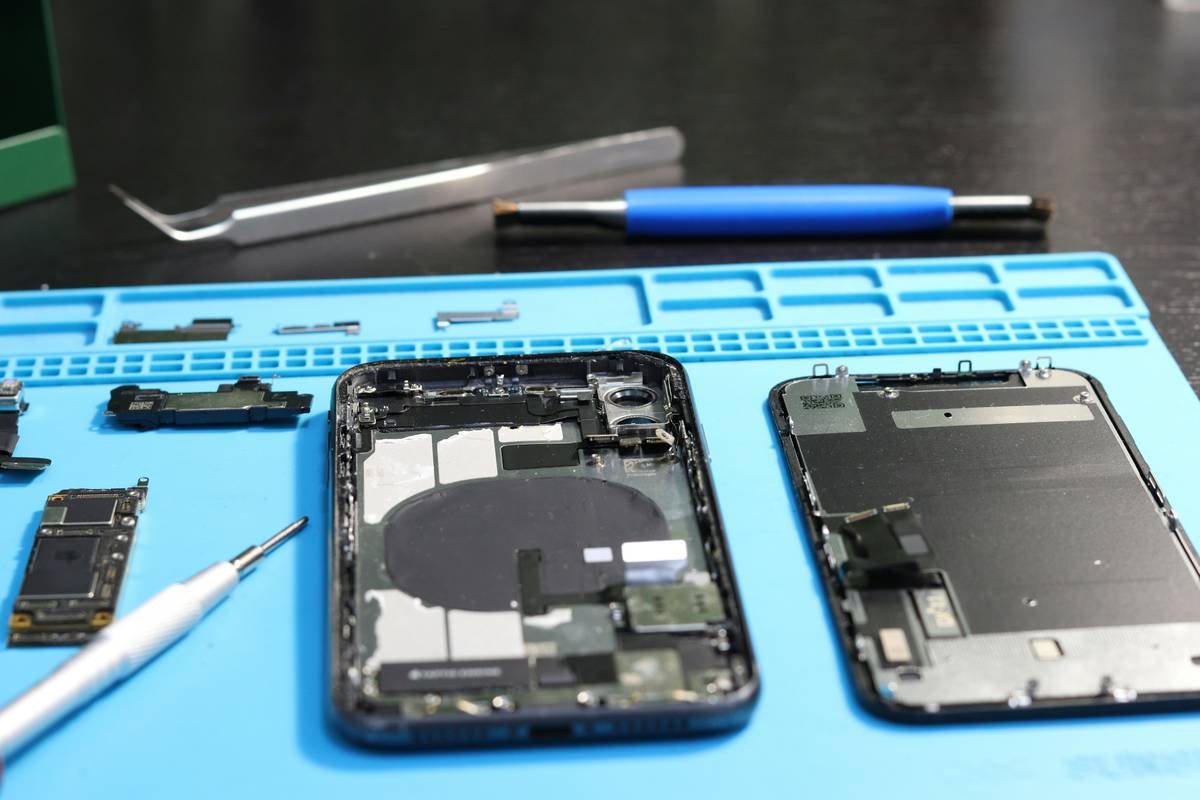

Imagine you just bought a brand-new smartphone, only to find it breaking down after the manufacturer’s warranty has expired. Frustrating, right? This is where credit card extended warranties come in. These lesser-known benefits can extend the manufacturer’s warranty on your covered accessories, giving you peace of mind and potentially saving you a fortune.

### Section 2: Step-by-Step Guide/Instructions

How to Check If Your Accessory is Covered by Extended Warranty?

- Review Your Credit Card Agreement

- Contact Your Credit Card Issuer

- Keep Your Receipts and Documentation

- Make a Claim When Needed

*Optimist You:* “The fine print isn’t so bad, right?” *Grumpy You:* “Ugh, like reading a novel in a foreign language—coffee, please!”

Start by locating your credit card agreement. Look for sections related to “extended warranty” or “purchase protection.” This will give you a clear idea of what types of items are covered and for how long.

*Optimist You:* “They’re here to help, I promise!” *Grumpy You:* “Sure, after an hour on hold, maybe.”

If you can’t find the information in your agreement, call your credit card issuer. They can provide specific details about your coverage and any limitations.

*Optimist You:* “A little folder can go a long way!” *Grumpy You:* “And a lot of paper clutter, but okay.”

Always keep your receipts and any documentation related to your purchase. This is crucial for making a claim if and when you need to use the extended warranty.

*Optimist You:* “It’s like a safety net, ready to catch you!” *Grumpy You:* “Hopefully, without too much paperwork drama.”

If your accessory breaks down, gather all the necessary documentation and follow the instructions provided by your credit card issuer to file a claim.

### Section 3: Tips/Best Practices

How to Maximize Your Extended Warranty Benefits

- Register Your Purchase

- Understand the Terms and Conditions

- Keep Your Credit Card Active

*Optimist You:* “A quick form can save you a lot of hassle!” *Grumpy You:* “Great, another form to fill out. Joy.”

Some credit cards offer a registration process for your purchases. This can streamline the claims process and ensure you have all the necessary information on file.

*Optimist You:* “Knowledge is power!” *Grumpy You:* “Yeah, and sometimes it’s a headache.”

Read the fine print carefully. Know what is and isn’t covered, and understand any exclusions or limitations.

*Optimist You:* “Staying active keeps your coverage alive!” *Grumpy You:* “So, no canceling that card, got it.”

Some extended warranties require that your credit card remains active and in good standing. Make sure you don’t inadvertently cancel your card and lose your coverage.

### Section 4: Examples/Case Studies

Real-World Success Stories: How Others Benefited from Covered Accessories

Case Study 1: The Broken Laptop

*Optimist You:* “It’s like magic, really!” *Grumpy You:* “If by magic, you mean a bunch of paperwork, sure.”

Sarah purchased a new laptop for her freelance design business. After a year, the screen started flickering. Her credit card’s extended warranty kicked in, and she was able to get the laptop repaired for free. This saved her hundreds of dollars and kept her business running smoothly.

Case Study 2: The Faulty Camera Lens

*Optimist You:* “A happy ending for a broken lens!” *Grumpy You:* “As long as the photos still look good, I guess.”

John, a professional photographer, bought a high-end camera lens. Six months later, the autofocus stopped working. His credit card’s extended warranty covered the repair, allowing him to continue his photography without a financial setback.

Common Questions About Covered Accessories

- What is an extended warranty?

- Are all accessories covered by the extended warranty?

- How do I make a claim under the extended warranty?

- Can I use the extended warranty with any credit card?

- Is there a limit to the amount that can be claimed?

An extended warranty, also known as a service contract, extends the manufacturer’s warranty on a product. It can cover repairs, replacements, or both.

No, not all accessories are covered. Always check your credit card’s terms and conditions to see which items qualify.

Contact your credit card issuer and follow their instructions. Typically, you’ll need to provide proof of purchase and a detailed description of the issue.

No, not all credit cards offer extended warranties. Check your card’s benefits or contact the issuer to confirm.

Yes, there is usually a cap on the amount that can be claimed. This varies by card, so review your card’s terms and conditions for specifics.

### Conclusion

In a world where technology and accessories can be expensive, knowing how to leverage your credit card’s extended warranty can be a game-changer. By following the steps outlined in this post, you can ensure that your covered accessories are protected and that you’re not left out of pocket when things go wrong.

Remember, the key is to stay informed, keep your documentation organized, and don’t hesitate to reach out to your credit card issuer for help. Happy spending—and protecting!